Till 2016 the insurance industry was far behind modern IT tendencies applying out-of-date technologies. But in 2017 insurance companies felt the need for changes, as they saw the necessity for insurance mobile platforms. Despite multiple pitfalls, they got inspired by forthcoming development opportunities.

Insurance companies shall consider their apps as a real win, as in 2019 experts predict a 4% increase in insurance app users.

Thus, our task today is to see why and in what way developing of insurance mobile program can strengthen your business. Thus, we begin with the most important – the actual benefits of using mobile insurance platforms. Shall we?

#1. Processes automatization

Mobile services as bright representatives of advanced technologies serve to automate complicated processes of business handling. Thus, if you develop a mobile app for an insurance company, you help yourself to facilitate company management.

#2. Business positioning

Developing a mobile platform gives you the possibility to put together all the information on your company and to present it in the most favorable way, showing potential customers all the advantages of enjoying your services.

#3. Expanding client base

It’s not a secret for anyone that an increasing number of people start applying insurance mobile and web services every day. To be among market leaders companies should move with the time and follow current tendencies. Giving users what they need is the way to attract more clients and gain their loyalty. Do you agree?

#4. Ongoing interaction with customers

Developers shouldn’t worry about costs recovering. When the insurance mobile platform is made wisely and thoroughly, you’ll inevitably return all the money invested. A great advantage of such an app is that it provides customers with 24/7 support, the possibility to interact with operators to receive answers to their questions. You don’t have to make operators be online around the clock – chatbots will do the job.

#5. Simple insurance act registration

Insurance mobile programs are to facilitate the process to draw up insurance deals. Thus, it turns to be a real win-win situation, as it takes only a few clicks for customers to receive insurance by means of a mobile platform.

#6. Individual approach to every client

The mobile insurance program is an instrument to gather data on all customers, and – based on info obtained – to provide each of them with personalized deals. Clients usually cannot say “No” to such offers, as they are made to meet their needs. It’s smart, isn’t it?

#7. Clients’ feedback

That benefit of you as a developer also becomes a great advantage for clients. When customers have a mobile service to report a claim, you have all tools you need to react in the quickest way to manage a complaint and to assist your clients. Your customers will definitely appreciate your care!

Mobile insurance services types

We have discussed key advantages you can get by developing a mobile program for your insurance company. In case you haven’t decided what kind of insurance platform you want to create, let’s have a look at the options. Here is an insurance app classification.

-

Life insurance mobile services

Life insurance is considered to be an instrument to ensure long-run financial assistance in case of accidents, managing unforeseen consequences to enable decent living conditions.

Such services are pretty expensive, thus, an insurance company shall come up with brilliant ideas to convince people to become their clients. A mobile software solution might be decisive for potential clients. Just think of it.

Looking for a reliable health insurance platform to see what it’s all about? Check Anthem Anywhere and Aetna Mobile apps. They worth being recognized.

-

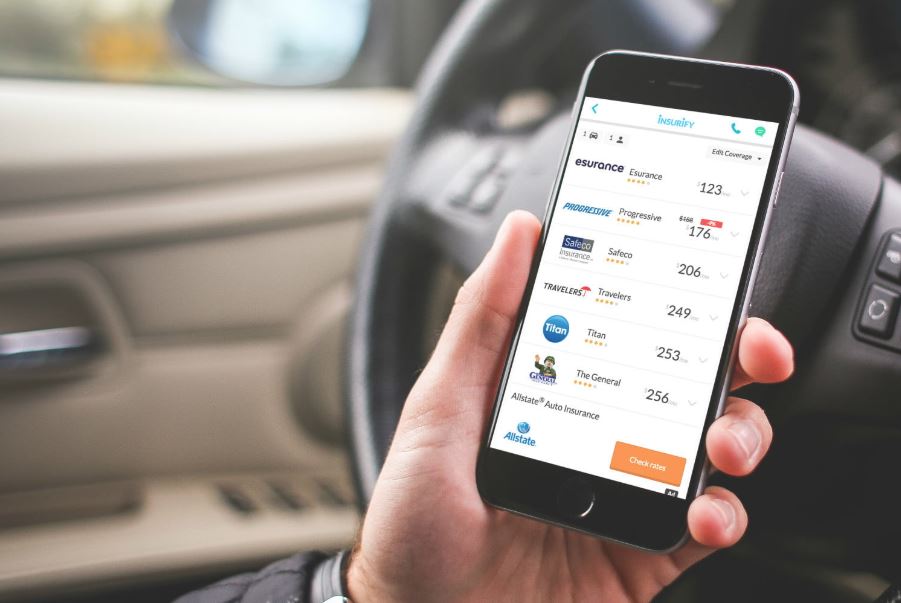

Car insurance services

That would be a great choice to focus your insurance app on this area, as all vehicles shall be insured. Drivers will appreciate the possibility to facilitate such a process.

From the developer’s point of view, mentioned mobile service is to simplify risk management, and for car owners, the platform helps in minimizing insurance policy costs. As you can see, both sides will enjoy the process of applying for car insurance mobile program.

Do you remember we were talking on interaction benefit? Given the platform is another instrument to ensure convenient and smooth overall communication. No matter what country a client is, insurers can easily verify the vehicle online, receiving all data on open claims in the system. And the process is all set – even the payment is transferred. Now it’s clear how convenient such application is, right?

Have a look at Allstate Drivewise and GEICO Mobile experience. They are bright representatives of car insurance mobile platforms.

-

Property Insurance services

Everyone would like to defend themselves against force major, like, natural disasters. Otherwise, people have to manage all the hassle emptying the budget. The market is full of multiple property insurance firms and corporations, thus, persuading people to become your customers could almost be mission impossible task.

Have you thought about considering home insurance niche? It’s a reliable means to facilitate the whole process and to boost customers’ engagement.

Allstate Digital Locker and Lemonade are considered to be truthful home insurance platforms.

-

Travelling insurance services

Travelers have to have health insurance when being overseas. Those who refer to travel agency services get it as part of a usual tour package. And independent tourists have to arrange things by themselves and quite many of them take advantage of website insurance bookings.

Don’t you think that mobile travel insurance option is much better? There could be more of happy clients, and, without a doubt, insurance companies will enjoy it as well.

We always have mobile devices on hand, therefore, insurance companies can get in touch with customers to assist them in any part of the world (provided an Internet connection, of course). Modern cell phone possibility to locate users can come in handy as well.

RoamRight and Revolut are decent travel insurance platforms. Their experience could be pretty useful for you.

-

Pet insurance services

Don’t be surprised – it’s not a typing error. In fact, people love their pets a lot, thus, such insurance programs are in demand today. No matter what pet people have, it’ll work.

Pet owners tend to insure their favorites against different diseases or loss, and much more. An interesting fact is that the Spanish government allows cat owners to make their own decision on whether to indemnify their pets or not. At the same time, Madrid laws demand all dog owners – no matter if it’s a big or small pet – to get insurance mandatory. That is another strong argument for insurance companies to think of developing a mobile insurance service.

Waggel is already assisting people to care about their pets. Take a pick at what they offer their clients.

We don’t think you still have any doubts on the necessity to build an app for your insurance company to grand your services through mobile gadgets. Now you know about the benefits you’ll get with such a platform. Are you thinking already on your strategies and looking for reliable developers? We are sure you’ll make it all work out for you and your clients.