Mechanical generation is a decent top-down macroeconomic pointer. It helps gauge the work market, last request, utilization, and expansion. While assembling is no more the essential driver of the U.s. economy, regardless it impacts the economy to an extensive degree—especially for incompetent specialists.

U.s. producing has been experiencing a bit of a renaissance of late because of shabby vitality costs. While there’s still a distinction between wages abroad and compensation here, low common gas costs are counterbalancing that distinction. Additionally, as wages increment abroad, the modest work arbitrage—exploiting lower wages—is fading away.

Increments in modern creation by and large flag increments in business. Lower-talented specialists have battled since the budgetary emergency. This has hosed total interest and utilization. Things are at long last beginning to enhance as development occupations bounce back and more organizations begin to move to coastal generation.

Quality takes after the first quarter climate related lull

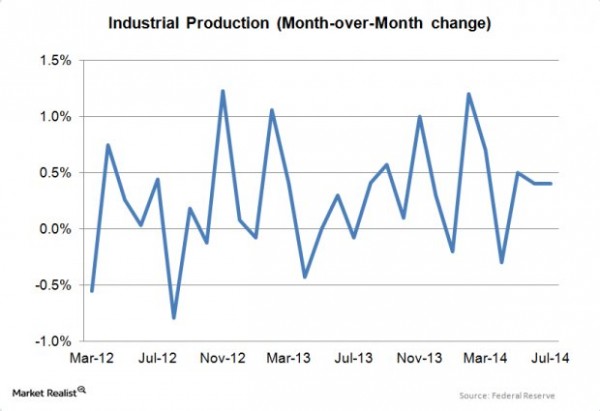

Mechanical generation expanded 0.4% in July. June was modified upward to 0.4%. Utility yield fell, while mining and assembling expanded. Business Equipment climbed 1.3%. It’s up 7% year-over-year (or Yoy). The shortcoming in utilities—down 3.4% because of an uncommonly mellow summer in the northeast and Midwest—discourages the number.

This implies that mechanical creation is stronger than it first shows up.

Suggestions for homebuilders

Homebuilders are very touchy to the economy. Any kind of lull can abandon them with abundance stock. In the event that home costs don’t climb, then developers are screwed over thanks to deteriorating stock that expenses them to keep up and account. They’ll take a gander at the creation numbers and believe that the economy is as of now extending tolerably.

On the off chance that anything, expanding creation conjectures an increment in procuring. This is doubtlessly bullish, or positive, for the economy.

Recuperation in the homebuilding business sector will be determined fundamentally by first-time homebuyers. In any case they’re attempting to discover employments. Until we see business development about-face to typical, it might be hard to see the 1.5 million lodging begins that are commonplace of an extension.

The business sector as of late broke one million. Truly, this has been an extremely discouraged level.

Homebuilders have noted that the increments in investment rates and home costs have started to hit request, especially at the lower value focuses. This is the first-run through homebuyer market.

In spite of the fact that the expense of leasing is route higher than the expense of owning, the first-run through homebuyer still isn’t happy enough with the work business sector to buy a home. Increments in assembling business will help to settle this issue.

Particular homebuilder stocks that will be decidedly influenced by progressions in purchaser feeling incorporate D.r. Horton (DHI), Lennar (LEN), Pultegroup (PHM), and Toll Brothers (TOL). An exchange approach to put resources into the division would be through the S&p SPDR Homebuilder ETF (XHB).